Getting A Mortgage When Self Employed

It might be harder to get a mortgage when self-employed, but it isn’t impossible! Self-employment brings lots of perks, but unfortunately, many self-employed individuals will tell you that getting a mortgage easily is not one of them. If you work for yourself and are looking to get on the property ladder or remortgage an existing property, this guide will help you to navigate the mortgage process with ease.

Before the credit crunch, it was easy enough for the self-employed to get on the property ladder because of self-certification mortgages. These were aimed at freelancers and contractors and offered a way for them to get on the property ladder without having to share years and years worth of accounts. For those hoping to get on the property ladder while self-employed, the self-cert mortgage allowed applicants to simply tell the lender their income without providing evidence.

Unfortunately, this led to some people lying about their income in order to secure a bigger mortgage. These have now been banned in the UK following the credit crunch as they were prone to abuse. With this type of mortgage banned, it has never been more difficult for the self-employed to get a mortgage. Company directors will often have a hard time getting a mortgage while their employees will enjoy a much more straight-forward process.

If you are looking to get on the property ladder, this guide will tell you everything you need to know about getting a mortgage when self-employed. From choosing the structure of your business to preparing your accounts, getting a mortgage when self-employed might not be easy, but it isn’t impossible.

There’s no such thing as a self-employed mortgage

When applying for a mortgage as a freelancer or sole trader, you aren’t applying for a special type of mortgage. You are applying for the same type of mortgage as everyone else, you just need to jump through more hoops in order to verify your income. If you are being sold a special type of self-employed mortgage, this is often just a business loan which can be used as a mortgage. These will often cost more than a traditional mortgage and you may require substantial collateral.

Once you have jumped through the hoops for a traditional mortgage provider, you will be treated like any other lender. You will likely be able to borrow around four to five times your annual income. If you are applying with a partner, the process may be easier if they are in full-time employment.

What you need to get a mortgage

The key to a successful mortgage application for the self-employed is evidence. You need to show evidence of your income, usually in the form of accounts from the past two years, or your past two tax returns. The more evidence you can provide, the better. In general, you will need:

- Two year’s worth of accounts or tax returns

- An accountant

- Evidence of regular work

- A deposit

- A strong credit score

Lenders will usually base their decisions on your average profit for the past two years. Some lenders will also request that you have an accountant prepare your accounts. Some will also request that the accountant is certified or chartered, so bear this in mind if you choose to hire an accountant.

A good accountant will know what lenders are looking for and will be able to help you prepare up-to-date accounts before you apply for a mortgage.

If you don’t have two-year’s worth of accounts yet, it doesn’t mean that you can’t get a mortgage. Some lenders will also consider things like evidence of regular work, previous full-time employment or if you can show guaranteed future work. If you already have a mortgage, your existing lender may be able to help. They are far more likely to offer you a mortgage if you have an existing relationship. If you don’t already have a mortgage, one of the best ways to increase your chances of being accepted is to ensure you have a large deposit. At least 10% of the total value of the property is advisable.

How does your business setup change your mortgage application?

There are three main types of business structure and they will all have a different impact on the way your mortgage application is considered.

Sole trader

If you work alone then you will be classed as a sole trader. Keeping accurate records will be fairly straightforward as all of the company profits will be yours. Lenders will often look at your self-assessment tax return when making a lending decision. You should get a form called a SA302 which shows your income, expenses and tax due once you file your tax return. Make sure you provide this alongside your accounts.

Partnership

If you started your business with another person, you may have a partnership. Mortgage providers will want to look at your share of the profit from the business. It’s important that your accounts clearly show your share of the income.

Limited company

Setting up a limited company means that your personal affairs are completely separate from the business. A limited company will have to have at least one director and often a company secretary. Sole traders can also choose to set up as a limited company.

Directors often pay themselves a salary plus dividend payments. It’s important that you make this clear to the lender so that they can take both portions of your income into consideration.

How to prove your income

When you meet with a mortgage advisor, they will want to see your accounts for the past two years. These should be compiled by a chartered accountant who can advise you on how to make sure everything is up-to-date. You should make an effort to ensure you understand everything from your accounts. It makes a far better impression on your mortgage advisor if you can help to explain dips in income or any seasonal trends.

It’s common for self-employed individuals and their accountants to look for ways to legally reduce their tax liability. However, when it comes to applying for a mortgage, you suddenly want to prove that you have a much higher income. If you are planning to apply for a mortgage in the next few years, it would be advisable to speak to your accountant about how best to handle this. They will be able to advise you on the best ways to keep your tax bill down while still ensuring that you have evidence of healthy income.

Another common problem faced is for directors or limited companies. Some directors choose to leave profits in their business rather than take everything is salary or dividends. This is a very common practice and some mortgage lenders will take retained profits into consideration when making a lending decision.

In some ways, it can be more difficult for company directors to get a mortgage than it is for the people they employ. If you are concerned about your income status, a mortgage broker will be able to help you find a lender that will take these things into consideration.

If you are hoping to borrow more than £500,000 then you should ask your mortgage broker to consider private banks as an option. These will often have far more flexible terms and can take a full range of income sources into consideration.

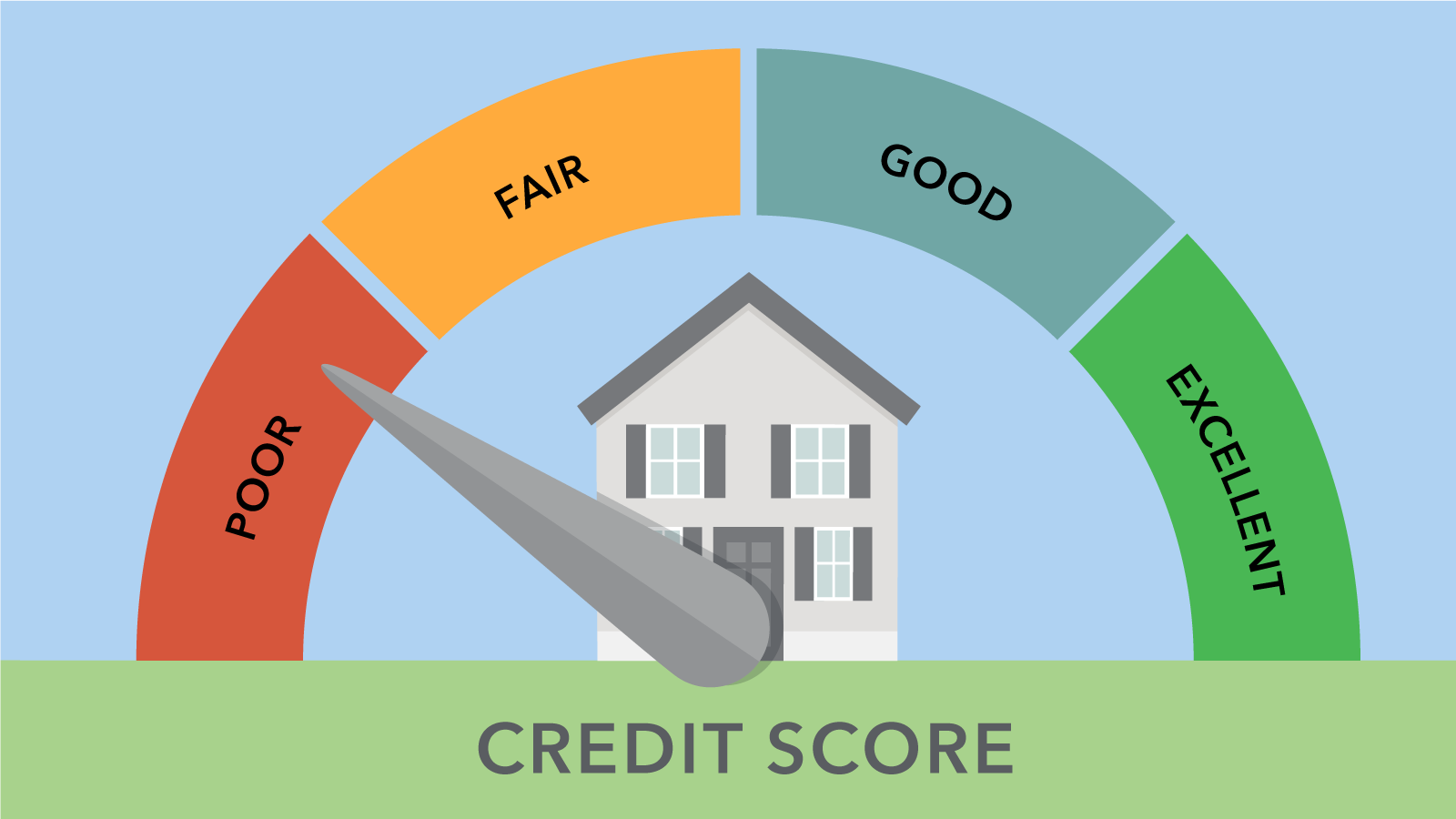

Cleaning up your credit score

When applying for a mortgage, your credit score is one factor that features heavily in the lending decision. If you aren’t sure what your credit score is, there are plenty of free sites that will allow you to see your credit report for free. There are three different credit scoring bureaus in the UK, and each of them will have different criteria. In order to get a more complete picture of your credit score, sign up to each of them.

There are some simple steps you can take to help clean up your credit score in advance of applying for a mortgage. To start with, make sure that all of your accounts are up-to-date and that you don’t miss any payments. Next, make sure that you are using less than 50% of your overall credit limit. Paying off your credit card in full every month is a great way to boost your credit score. And finally, make sure your name is on the electoral register and that your address details are up-to-date.

Your credit score is one part of the mortgage application process that doesn’t take into consideration your self-employed status. However, it’s a good way to show that your income allows you to keep your accounts up-to-date so it’s worth paying attention to this.

Finding the right mortgage

Before you start your search for a new home, it’s important to speak to lenders in order to find out if they will give you a mortgage and how much you can expect to be able to borrow. A mortgage broker can be invaluable for the self-employed as they will have vast knowledge and experience of the industry. They will be able to tell you which mortgages you are more likely to be accepted for and what information you will need to provide for each lender.

A mortgage broker can also help identify which lenders will accept less than two year’s worth of accounts, which ones will consider retained profits, and perhaps most importantly, which will give you the best rate.

Before you start looking for a mortgage, you should make sure that your accounts are up-to-date and that you have your deposit secured. The bigger the deposit you can get, the more likely you are to get a better rate on your mortgage.

Starting your property search

If you have found a mortgage provider that you are happy with and they are happy to proceed, they may offer you something known as an “Agreement In Principle”. This is a statement from the lender outlining what amount they would be able to lend you if you were to go ahead with your application.

Once you have your agreement in principle you can start the house search with confidence. This statement helps to speed up the buying process as it gives you some confidence that you are searching for homes in the right price range. However, it's important to remember that an agreement in principle doesn’t mean that you will definitely have your mortgage application approved.

Lots of things have to fall into place for a mortgage to be approved, and unfortunately, this list gets even longer when you are self-employed.

Self-employed mortgages: Dos and Don’ts

If you are thinking about applying for a mortgage in the next few years, consider the following dos and don’ts.

- Do. Hire a certified accountant or a chartered accountant to help prepare your accounts or your tax return. If you are trying to legally keep your tax liability down, an accountant will be able to show you how you can still show healthy income.

- Do. Keep accurate and up-to-date accounts. Make sure that you understand your accounts and that you can explain dips in profit or any seasonal changes to your income.

- Do. Enlist the help of a mortgage broker to help you to understand your options. They will have extensive experience with mortgage providers and will be able to help you find a lender that is more likely to accept your application.

- Do. Reach out to your current lender if you are self-employed and are looking to move house or remortgage your property. They have an existing relationship and may be more likely to accept your application.

- Don’t. Change your income too much for tax purposes. This will have a huge impact on your ability to get a mortgage, and it could take years to correct the damage.

- Don’t. Give up! It might seem like a headache to get a mortgage when you are self-employed, but it will be worth the effort once you step through the front door of your new home.

For further information, please visit our self-employed mortgage services page.