Self-employed buy-to-let: what you need to know

Being self-employed can be very rewarding. You have the opportunity to set your own working hours and boost your earnings. This can lead to far more lifestyle and income flexibility than the majority of full-time employees.

For many freelancers, diversifying their income streams can be a good way to ensure a steadier income and get out of the feast and famine cycle. Becoming a landlord while self-employed is one way to ensure you always have a steady stream of income.

The availability of buy-to-let mortgages might be shrinking, but they are still a viable option and worth considering if you’d like to get on the property ladder and start earning passive income.

The rules for buy-to-let mortgages have changed a lot in recent years, but it is still possible to make a tidy profit from becoming a landlord. However, becoming a landlord when you are self-employed isn’t easy.

In many cases, company directors will have a harder time purchasing a buy-to-let property than their own employees. That said, it isn’t impossible, so if you’re serious about becoming a landlord, there are steps you can take to ensure your buy-to-let mortgage application is successful.

Lenders will often want self-employed individuals to jump through far more hoops than the average applicant. It’s important to remember that these extra steps are in place to protect you just as much as the lender. Lenders want to ensure they are being responsible and not lending to individuals who might not be able to afford the repayments in six-months time.

With the rise of the self-employed gig economy, more and more lenders are coming around to the idea that some applicants will have a self-employed work history. If you’re interested in becoming a landlord while self-employed, follow these simple steps… For self-employed mortgages this past post.

Get your records in order

Keeping accurate financial records is essential as a freelancer, but it becomes even more important when the time comes to apply for a mortgage. Any lender will want to see at least two year’s worth of financial records, so it’s best to prepare this before you make your application.

In addition to your financial records, lenders will also want to see some other important documents. You should be prepared to present the following in support of your application:

- Company accounts for the past 2-3 years. This will vary depending on the lender, but most will want to see at least two year’s worth of accounts.

- Bank statements showing regular income

- SA302 statements for the past 2-3 years. These are statements from HMRC detailing your tax liability and, therefore, your income.

- Evidence of your deposit

- Photo ID and proof of address

Is a self-cert mortgage an option?

Self-cert mortgages were designed for borrowers with irregular income, such as the self-employed. This type of mortgage helped many contractors and freelancers to get on the property ladder. Lenders trusted mortgage applicants to accurately represent their income in their application.

Unfortunately, these were widely abused and led to many people applying for more than they could afford. Imagine if you had a strong start to your business but then the hype wore off and your profits dropped. If you applied for a mortgage based on the first few months of trading, you might soon find that you can’t keep up with repayments. For this reason, many lenders will either take the average profit for the past two-years.

This type of mortgage was banned in 2011 amid concerns that lenders were being irresponsible by not confirming income. Lenders must now carry out in-depth affordability checks. You can still apply for a self-cert mortgage through some European providers, but this would not be covered by the same protections as a UK mortgage. With Brexit looming on the horizon, it would be wise to consult with a mortgage provider before going down the self-cert route.

How much can I afford to borrow?

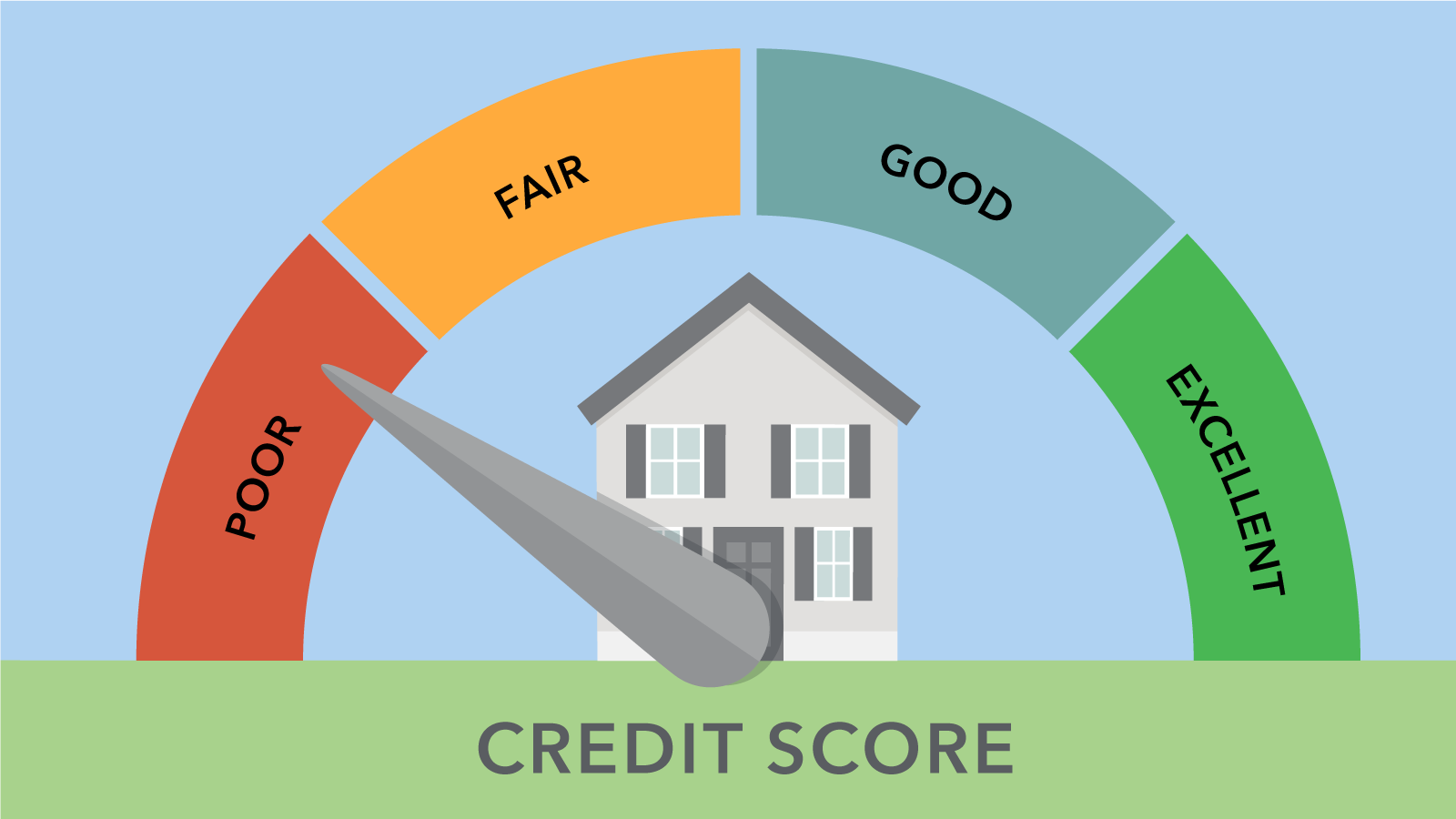

If you aren’t sure what a lender is likely to give you, it’s a good idea to speak with a mortgage advisor. They will be able to look at things like your credit report and your SA302 statements and arrive at a figure that is likely to be accepted by a lender.

Many people head straight to the banks and are disappointed to be turned down for a self-employed mortgage. It’s important to remember that some banks are more likely to lend to self-employed individuals than others. So, a rejection from one lender doesn't mean that you are ineligible for a mortgage. It just means that you might need to adjust the amount you are applying for or try a different lender.

A good mortgage advisor will be able to point you in the direction of the banks and lenders most likely to help self-employed individuals.

Buy-to-let mortgage restrictions

If you are planning to let your property, it’s important to ensure you have the right mortgage. A buy-to-let mortgage will typically be more expensive than a residential mortgage. This is because of the higher risk to the banks. Essentially, you are relying on the rental income to pay the mortgage, but this isn’t always guaranteed.

You will also need a larger deposit for a buy-to-let mortgage. This is typically around 25% of the property value. Some of the best deals require a 40% deposit. Often, the more deposit you can afford, the better rates you will be able to secure.

Things to consider

- It’s always best to get your documents in order before applying for a buy-to-let mortgage. It can take up to two weeks for SA302 forms to arrive, so you don’t want this to delay the application process.

- Some mortgage providers will require you to have your financial records prepared by a chartered accountant. Bear this in mind when selecting your accountant.

- If you’re in full-time employment and thinking about going self-employed, think carefully before taking the plunge. Most mortgage providers require at least two full year’s of accounts before they will consider your application. If you’re thinking about going self-employed, it might be easier to stay in full-time employment until you have purchased your property and let it out. You can then use this financial freedom to make the switch to self-employment.

- If you are a company director and you take a basic salary, this often isn’t enough to put you in the full-time employed category. You will still be classified as self-employed and will need to jump through the same hoops. It’s also important to find a lender that will include income from other sources such as dividends and retained profit.

- Some lenders will have minimum income requirements for individuals and couples. If one half of the couple doesn’t meet the income requirement, it might be best for one party to apply for the buy-to-let mortgage on their own if they can afford it.

- If you already own a property and are looking to expand your portfolio then you should always approach your existing lender first. It’s always easier to work with a lender if you have a pre-existing relationship and a track record of making payments on time.

- If you have been in the habit of legally adjusting your income in order to reduce your tax liability, you will need to stop this. When applying for your buy-to-let mortgage, lenders will look at your tax liability as proof of your income so you will want this to be as high as possible, even if this means paying more tax.

A buy-to-let mortgage can be more expensive than a residential mortgage, so it’s important to ensure that you have chosen a property that will deliver a strong rental yield for years to come. It might be more difficult to get a buy-to-let mortgage when you are self-employed, but it isn’t impossible, you just need to know where to look.