Many young people dream of getting on the property ladder. But with many mortgage companies asking for a minimum 10% deposit, and the price of houses spiralling out of control, this will remain nothing more than a dream for most.

Across the UK, the average deposit required to purchase a home is between £10,000 and £20,000. Unless you have rich parents willing to help you out, or you’ve managed to land a lucrative job from a young age and start saving, even this might be out of your reach.

In an effort to help more young people onto the property ladder, the government has announced a new mortgage guarantee scheme. This means that prospective homeowners could purchase a property with a small deposit of just 5%.

While this might sound like good news for those hoping to get on the property ladder, it’s important to consider the bigger picture. These mortgages certainly don’t come cheap, and might not be ideal for every borrower.

What is the 95% LTV mortgage scheme?

LTV means loan to value, and it shows how much loan is required as a percentage of the property value. A 95% LTV mortgage means that the borrower offers a deposit worth 5% of the value of the house. The mortgage provider offers the remaining 95%. Borrowing a higher amount can mean a longer repayment term, more interest and higher monthly repayments.

As a borrower, the mortgage scheme operates just like any other mortgage. There is no difference between 95% LTV mortgages under the government scheme and any other 95% LTV service.

The primary difference is in the way the lenders make their decision. With the government backed scheme, the government agrees to shoulder some of the cost if the borrower is unable to pay back the mortgage. This makes it possible for lenders to relax their lending criteria.

When will the 95% LTV mortgage scheme start?

This scheme opened on April 19th 2021 and will run until December 2022. This scheme is similar to one that operated between 2013 and 2017. This was called the 5% Help To Buy Government-backed mortgage scheme.

Not all lenders are signed up to the scheme, but if they do sign up, they have to agree to offer a 5-year fixed price mortgage as part of their selection of 95% LTV mortgage products. Fewer and fewer mortgage providers have offered mortgages with low deposits since the Coronavirus pandemic.

The introduction of this scheme is welcome news for those who have been unable to purchase a home as a result of strict lending criteria, spiralling house prices and an insecure job market.

Who can benefit from this scheme?

Not everyone is eligible for the scheme, so before you get your hopes up, consider the following. First and foremost, this scheme is not limited to first-time buyers. This is great news for anyone thinking about moving house and wanting to free up some equity.

The criteria for the 5% deposit mortgage scheme is as follows:

- You have to be buying your main residential home. These mortgages cannot be used for second homes, holiday homes or buy to let properties.

- The property cannot be worth more than £600,000. If you have your sights set on a high-value property, you’ll have to raise a bigger deposit.

- The property cannot be a new-build. What qualifies as a new build will vary by lender, but they will typically be rejected for a 95% LTV mortgage. This is because new build properties often struggle to retain their value, so a mortgage provider could lose out if the borrower were to default on their mortgage payments. Since the government is offering a guarantee on the mortgage, they set the terms.

- Your deposit must be between 5% and 9% of the property value. This means you are borrowing 95% to 91% of the property value.

- You will need to pass the lender’s affordability checks. These will vary by lender and can cover everything from income to credit score.

Are 95% LTV mortgages a good thing?

While a government-backed mortgage sounds tempting, there is nothing special about this type of mortgage. The lenders might be hyping them up, but this isn’t for the borrower’s benefit. And while several major players might be taking part in the scheme, this might not be the best option for you.

If you are truly struggling to get on the property ladder, this can be used as a last resort, but prospective homeowners with a little more flexibility should widen their scope.

The only reason this type of mortgage has been introduced is to encourage lenders to start offering a lending product they had started to phase out. At the moment, the following lenders are signed up to the scheme:

- Lloyds

- Halifax

- Bank of Scotland

- Natwest

- Santander

- Barclays

- HSBC

Remember that many of these were already offering 5% deposit mortgages before the pandemic, and the government-backed scheme is no different to their other products.

The government-backed mortgages are better for the lender, as they offer additional security. But they offer no additional benefits to the borrower. When shopping around for mortgages, remember that this scheme might not offer any additional benefits. You could be better off with a different mortgage type or saving a little longer to offer a bigger deposit.

An alternative to the 5% deposit mortgage

If you have a small deposit, a better option could be the Help To Buy Equity Loan. This will allow prospective borrowers with a 5% deposit to borrow up to 20% of the value of the property from the government.

This is an interest-free loan for the first five years and will enable buyers to increase their deposit amount from 5% up to 25%. However, these loans can only be used on new-build homes.

Experts are warning this scheme is expensive

Affordability should be your primary concern when securing a mortgage, and this type of mortgage might not offer the best value. If you are determined to get on the property ladder with a smaller deposit, be prepared for much higher rates and a more expensive mortgage in the long term.

The following table demonstrates how a bigger deposit will secure a cheaper mortgage, based on a £150,000 property.

|

95% LTV |

90% LTV |

60% LTV |

| 2 year fixed |

3.69% + £594 fee

Fees: £9,054 |

2.99% + £1007 fee

Fees: £8,196 |

1.13% + £1001 fee

Fees: £4,621 |

| 5 year fixed |

3.45% + £35 fee

Fees: £8,537 |

3.37% + £1,024 fee

Fees: £8,220 |

1.28% + £1025 fee

Fees: £4,354 |

| 2 year tracker |

3.99% + £35 fee

Fees: £9,034 |

3.59% + £999 fee

Fees: £9,054 |

1.39% + £1016 fee

Fees: £4,772 |

As you can see, a higher LTV will secure you a much better rate, which will reduce your expenditure and the lifetime costs of the mortgage. If you are able to stay put and keep saving, you could secure a much better deal.

How can I apply for a 95% LTV mortgage?

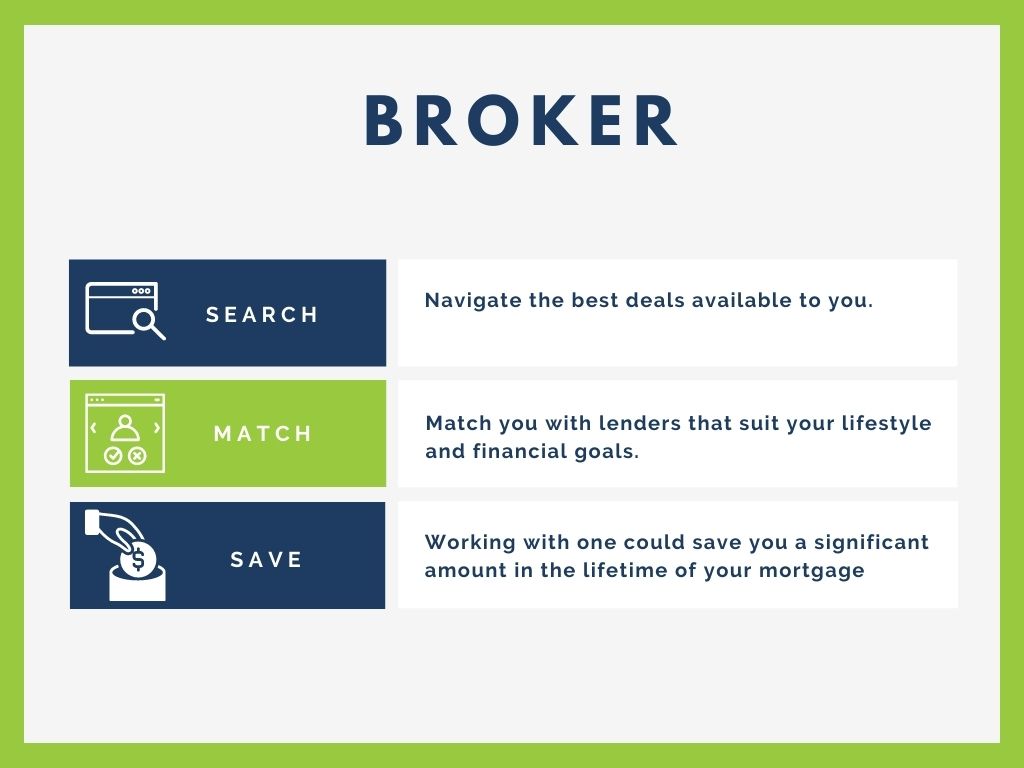

If you are still keen to go ahead with this mortgage type, you will need to apply as you would for any other mortgage. You can choose to go directly to a lender or work with a broker to shop around for the best possible deal.

If you are hoping to make this process as cheap as possible, working with a broker could help you to save money on your application. They will be able to help present you in the best possible light and minimise your risk of rejection.

While a broker does add additional fees, they also help to save you money in the long term by connecting you with the best possible lender. The lender they suggest might not be offering the government-backed scheme, but remember that the scheme offers no additional benefits to you.

Apply for a 90% LTV mortgage if you can

If you’re on the border with a 9% deposit, you might be better off waiting until you have saved a 10% deposit as this will open up far more lending opportunities.

If you aren’t already, using a Lifetime ISA account could help you to boost your savings. You can save up to £4000 per year and receive a government cash bonus of 25%. So after a year, you’d have an additional £1000 added to your savings.

LISA savings accounts can be used for retirement or purchasing a home, so you would be able to access the money without a penalty. You must be aged between 18 and 39 when you open your LISA account.

What happens if you default on a 95% LTV mortgage?

If you are unable to keep up with the payments on your mortgage, there is no additional help from the government. A government-backed loan does not benefit the borrower, rather, the lender enjoys some financial protection.

The government guarantees 95% of any losses above 80% LTV. So on a £200,000 property with a 95% mortgage, the lender would not guarantee losses on the first £160,000. They would guarantee 95% of the remaining £40,000.

If you miss your mortgage payments, your home could be repossessed and sold by the lender. They would look to recoup their original investment and any associated costs of selling your home. Since lenders typically sell repossessed properties below market value, you would likely lose your deposit.

This is why it is important to ensure your mortgage repayments are affordable now, but also if your circumstances were to change. Stress-test your finances to see what would happen if you or your partner were to lose their job.

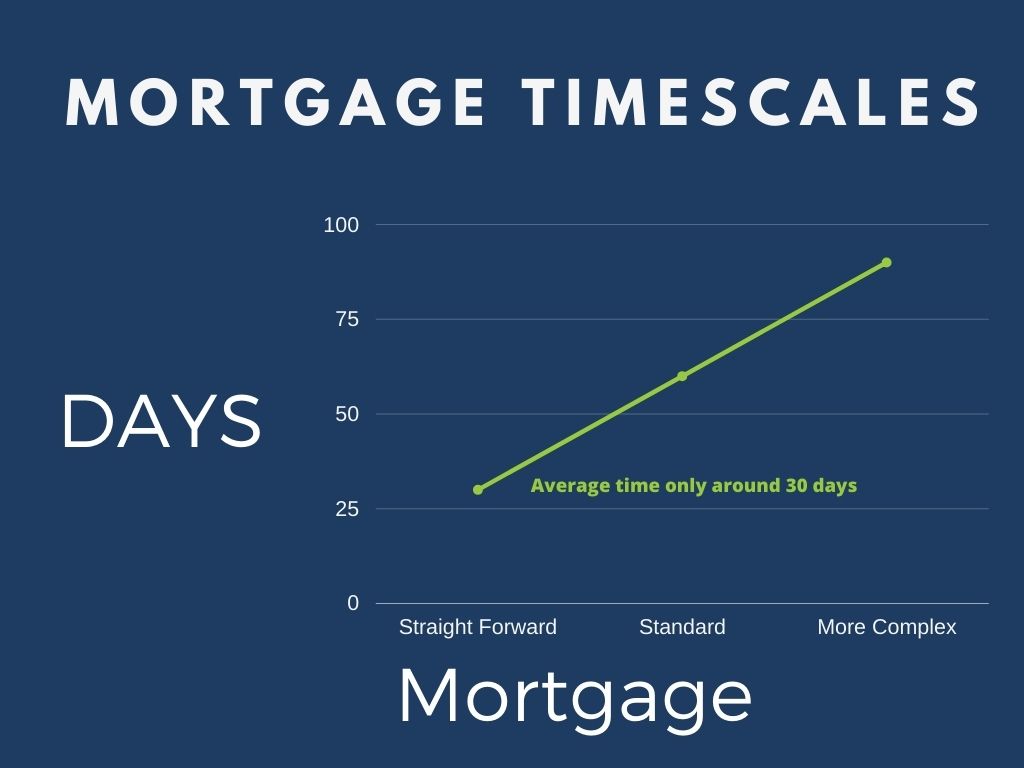

The 95% LTV mortgage application

Although the government is backing this scheme and offering some protection to lenders, they are still required to carry out affordability checks to ensure you will be able to make repayments on time every month.

There are several stages to the mortgage application. Borrowers will typically apply for a mortgage in principle, which allows them to begin searching for a house with confidence. They can also put in an offer with a mortgage in principle, and then complete the application process once their offer has been accepted.

Lenders will want to see the following information as part of their affordability checks:

- Proof of employment and income

- Credit history

- Bank statements for the past 3 months

- Your deposit amount

Remember that all mortgage applications are simply an assessment of affordability and risk. Once a lender has determined you can afford the mortgage, they then decide how risky it would be to lend to you.

With a larger deposit, you are borrowing less money and shouldering more of the risk. So if you default on your mortgage payments, the lender has a better chance of recouping their investment.

With a 95% LTV mortgage, you expose the lender to greater risk, which means they will charge a higher interest rate. Prospective homeowners who are able to save more money or set their sights on a cheaper property might be better off in the long term by choosing a 90% LTV mortgage over a 95% LTV mortgage.

Rejection is still a possibility

The government guarantee does not extend to borrowers. This means that, although the risk is reduced for lenders, they still have an obligation to make sure they are lending responsibly. Rejection is possible, particularly if you have a small deposit, poor credit score and frequently run into financial problems, you might struggle to get accepted.

If you are rejected, we’ve provided a few recommendations to help get you back on track at the end of this article.

How to increase your chances of being accepted

If you are determined to go ahead with a 95% LTV mortgage, there are steps you can take to make your application look better to lenders. The following steps could help you to secure a better rate on your mortgage, or at the very least, reduce your chances of being rejected for a mortgage.

Improve your credit score

A higher credit score and spotless credit history will help to reassure lenders that you are responsible with money. If you have no credit history, this can reflect just as poorly as bad credit history. Try taking out a credit card with a low credit limit and using it little and often. Make sure you pay it off in full every month. You can also apply to have your rental payments included in your credit score.

Keep your spending under control

Lenders like to see that your expenses are what you say they are. So if you tell them in your application that you only spend £100 a month on takeaways, then you shouldn’t have £400 in UberEats charges every month. Keep your spending in check and make sure it matches your stated expenses. Make sure you end every month with a surplus in your account.

Get your deposit from savings

It’s common for parents to want to help their children onto the property ladder, but try to save your deposit if you can. This shows good financial responsibility and a monthly surplus in income. If you have to take your deposit from a family member, it isn’t the end of the world, but you could improve your position by adding this to your own savings.

Avoid end of the month transfers

When it reaches the end of the month, those who struggle to manage their money might ask for short-term loans from friends and family. Try to avoid this where possible. Mortgage underwriters will look at small loans from friends and family as a sign that you struggle to budget throughout the month. They might also interpret it as a sign that you are struggling to make your salary stretch to the end of the month.

Steer clear of betting websites

Betting is another kind of financial behaviour that lenders don’t like to see. The occasional flutter is fine, as long as you aren’t losing large amounts. But substantial or frequent transfers to betting websites can damage your chances of being accepted.

End each month with money leftover

Lenders want to see that you have a surplus of money by the end of the month. This shows that you have enough income, are in control of your finances, and can handle any unexpected blows. Working with a broker can help as they will tell you how many months of bank statements each lender will ask to see. This can help you to plan and make sure your finances are in order.

Pay down your debts

To boost your credit score, try to keep your credit usage under 40% of the total amount. Once credit cards are paid off in full and no longer required, consider closing them as this will give mortgage providers some reassurance that you won’t rack up additional debts.

Avoid large purchase

A common problem that mortgage brokers face is that borrowers have flawless finances when they complete their mortgage in principle application, but then things change when they complete the full application. It’s not uncommon for borrowers to purchase large items like cars on credit, which can drastically alter your credit score. Even if you have the funds for large purchases, wait until after your application has been accepted.

Steps to take if you are rejected

While the 95% mortgage might offer some guarantees for the lender, they are still required to make sure the mortgage is affordable. If the mortgage would put a big strain on your finances, your application could be rejected.

If your application is rejected, follow these steps to get back on track. You might lose out on a home you really like, but remember that new homes go on the market all the time, so there could be an even better home out there.

- You should ideally wait a few months before submitting another application. This is because the application will show up on your credit report and this is a red flag to lenders.

- Address the problems in your original application. For example, if your actual spending doesn’t match up to your budgeted spending in your application, this needs to be addressed.

- Save more money. If you have to wait a few extra months, don’t be tempted to dip into your savings. Instead, focus on saving as much as possible. This could help to bump you up to the 90% LTV level, which will allow you access to more lending products.

- Speak to a mortgage broker. Sometimes the reason for your application being rejected is nothing to do with your personal finances. Sometimes it’s an admin error or missing information. Work with a mortgage broker to ensure your application is in order and check if there are any areas that could be improved.

- Stay positive. Being rejected for a mortgage application isn’t the end of the world. It might feel crushing at the time, but try to keep things in perspective. Waiting a little longer to get on the property ladder could allow you to save more money, access better lending products, and save money on your mortgage in the long term.

5% mortgage deposit summary

To sum up the points in this article:

- The 5% mortgages guaranteed by the government offers protection to lenders, not borrowers.

- If a borrower defaults on their mortgage, the government will cover any loss experienced by the lender.

- You will need a deposit between 5% and 9% of the property value.

- This type of mortgage is more expensive than other mortgage types.

- A government-backed mortgage is no different to any other kind of 5% mortgage.

- It is still possible to be rejected for a government-backed mortgage.

- The same application rules apply, and you will need to pay close attention to your finances.

- Saving a little extra money could give you access to a 90% LTV mortgage, which will offer much better rates.