Since April of 2013, there has been a government-backed incentive in place in the United Kingdom to help first time buyers purchase their first home and it’s the aptly named Help to Buy Scheme. The government has recently confirmed that this assistance is set to continue for the foreseeable future, guaranteeing that it will be available until at least 2023.

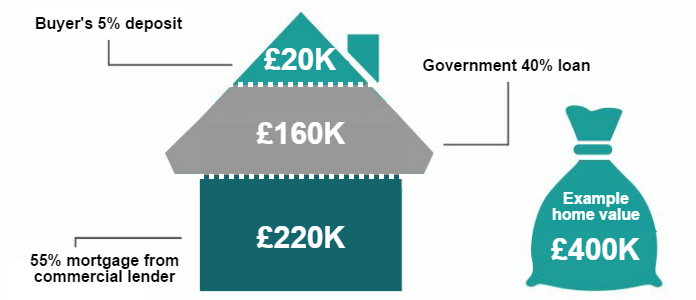

Essentially, what the scheme offers is an equity contribution of 20% across the majority of England, with 40% being provided to first time buyers in London due to the property prices in the area. This means that those taking advantage of a Help to Buy mortgage only need to put down a 5% deposit, which is considerably lower than the industry norm of around 15-20%.

The aim of the Help to Buy mortgage scheme is to help people who would otherwise have no possibility of affording the deposit for even an averagely-priced home, which currently stands at around £250k in the UK. Here we take a look at the scheme in closer detail, honing in on exactly what it is you need to know.

So, let’s take a look at the facts.