How to get a mortgage if you’re struggling

Getting rejected for a mortgage can be very distressing. Every lender has their own hoops you need to jump through, and sometimes you might fall short of their key requirements.

It’s important to remember that being rejected by one lender doesn’t mean that you will be rejected by all lenders. If you’ve recently been rejected for a mortgage, consider if any of the following situations apply to you.

- I have a poor credit score

- My income is low

- I only have a small deposit

- I moved to the UK less than three years ago

- I’m self-employed

Read on to discover how you can work around these common problems and finally get on the property ladder.

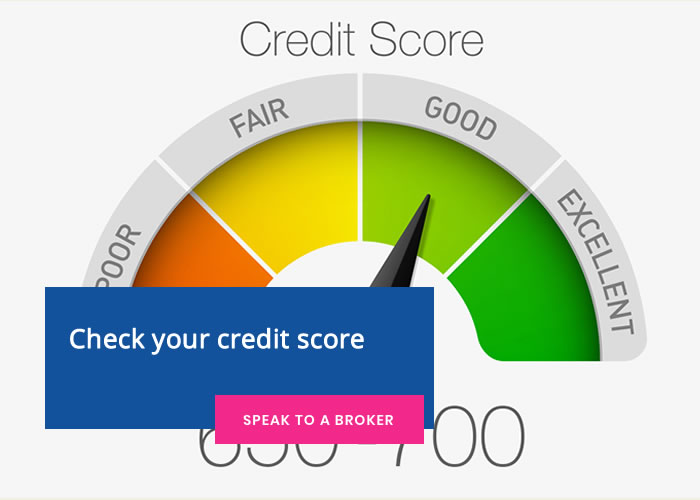

My credit score is holding me back

Your credit score is usually the first thing that mortgage providers will consider. Your credit score can differ depending on the credit scoring agency.

There are three main credit scoring agencies in the UK. They are Equifax, Experian and Call Credit. Your chosen lender might look at one, two or all three of them to asses the strength of your application.

A credit score helps lenders to understand your past relationship with money and borrowing. They can see things like your total amount of debt, missed credit card payments, utility bill arrears and even adverse credit history like CCJs. They can also check that your address history matches the information you provide.

If you have a poor credit score, this can impact your chances of being accepted for a mortgage. Before making an application to another lender, check your credit score with all available agencies.

Make sure the following details are correct and up-to-date.

- Your name and address

- Electoral roll details

- Your current accounts

- Closed accounts

- Satisfied CCJs are removed if 6 years have passed.

If there are mistakes on your credit report, this can impact your ability to secure credit.

The following steps will help to improve your credit score.

- Keep your details up-to-date.

- Make sure you never use more than 50% of your total credit limit.

- Avoid too many hard credit searches in a short space of time. This usually means waiting at least 90 days after every failed credit application.

When your credit score is improved, you can try applying for a mortgage again.

My income is low

Mortgage providers make their lending decisions based on affordability. If they have concerns that you won’t be able to afford the repayments on your existing wage, then they may reject your application.

Lenders also consider things like future affordability. If you lost your job and it took a few months to find a new one, would you be financially stable enough to keep up with payments? Or if interest rates increase, will the higher payments make your loan unaffordable?

Padding your income or being overly optimistic with your expenses is another warning sign to lenders.

A help-to-buy scheme might be more suited to your situation. You should also look at shared ownership as a way onto the property ladder.

I only have a small deposit

A mortgage lending decision is based entirely on risk. This is why house hunters with a big deposit are seen as more attractive. The large deposit helps to reduce the risk for the lender.

If you think you have been rejected because your deposit is too small, there are a few steps you can take.

- Look for a lower valued property. This will mean that your loan to value is higher.

- Save more money to increase your deposit value.

- Look for a help-to-buy scheme that could boost the value of your deposit.

- Use a shared ownership scheme to get on the property ladder with a smaller deposit.

I moved to the UK less than three years ago

One of the things that lenders look for is a history of ties to the UK. If you moved to the UK less than three years ago, you may struggle to secure a mortgage.

When filling in a mortgage application, you will often be asked for your address history for the past three years. If any of these addresses are outside the UK, you may struggle to secure a mortgage.

In many cases, you may simply need to wait until you have a history and evidence of living in the UK for more than three years before making your application.

Some lenders will be more inclined to accept applications from those with less history in the UK. Only by working with a specialist broker can you get access to these lenders.

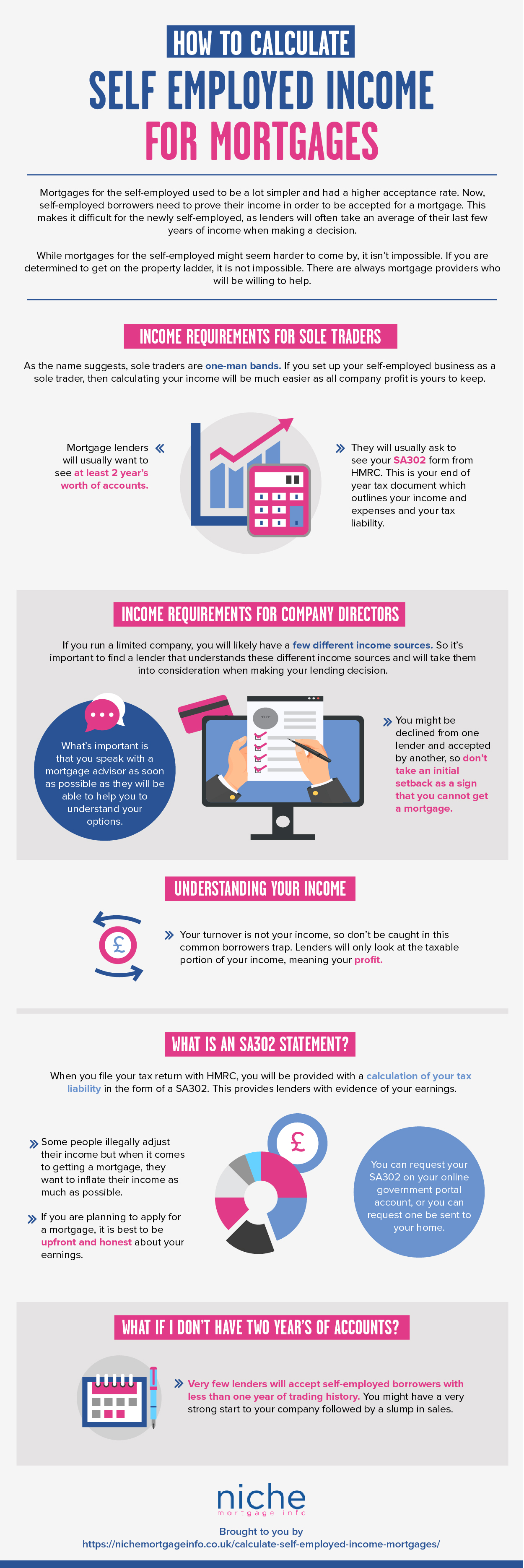

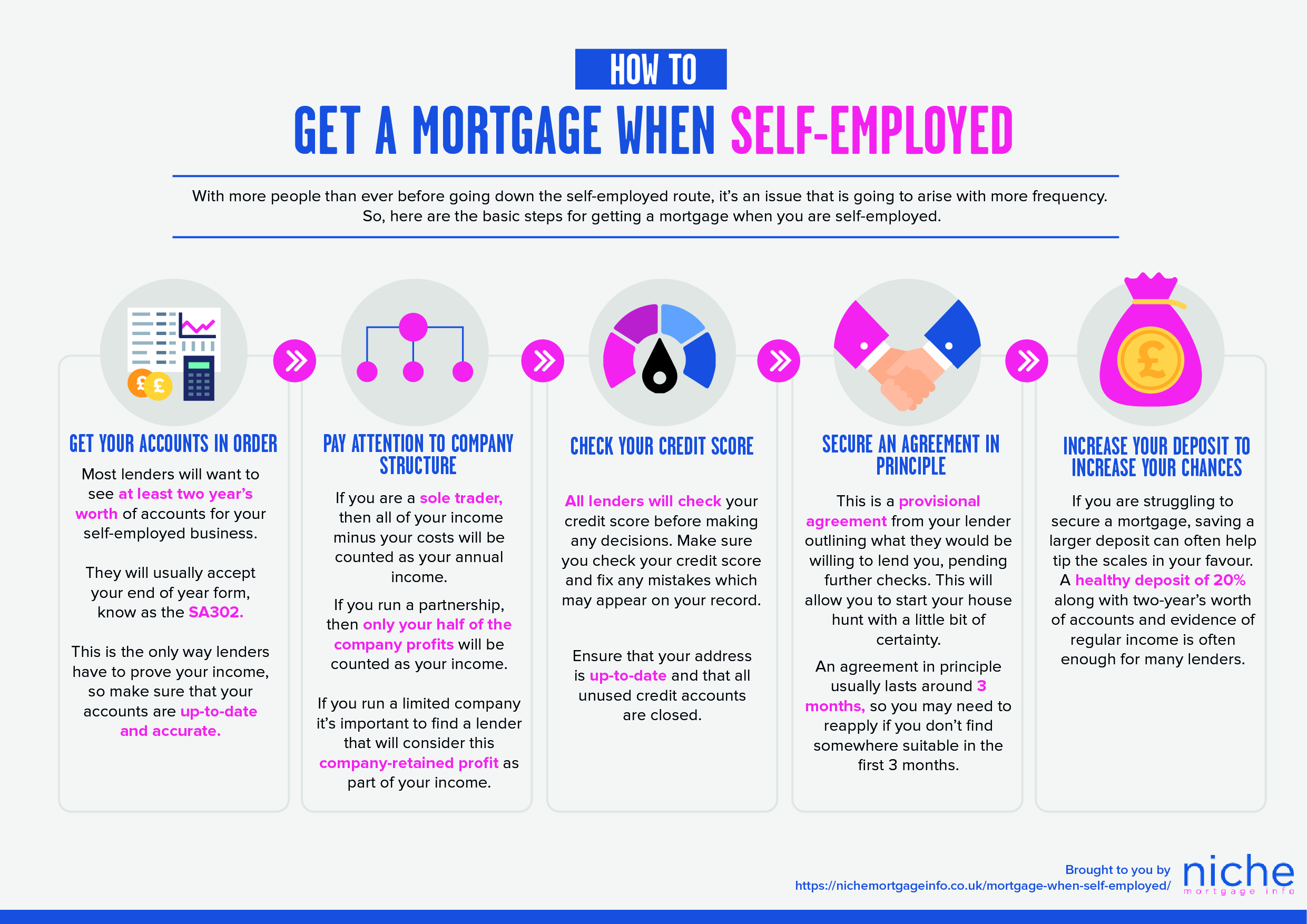

I’m self-employed

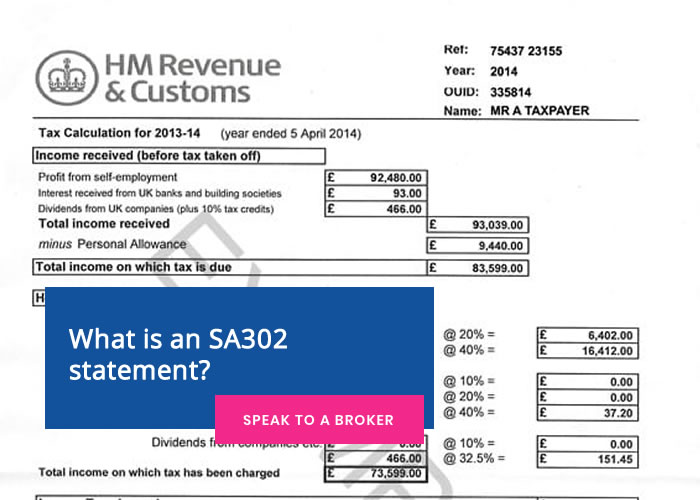

The self-employed often struggle to prove their earnings and convince mortgage providers that they are a safe bet. Unlike a monthly salaried job, freelance work is considered to be high risk. Your earnings might fluctuate, so you could struggle to make the payments.

If you are self-employed, you will typically need to provide two-year’s of accounts as evidence of your earnings. Lenders might take an average of your last two year’s earnings, or they could look at the most recent tax year as evidence of future earning potential.

Being self-employed doesn’t have to mean the end of your mortgage journey. While some high street lenders might be reluctant to give you a mortgage, an increasing number of specialist lenders see the benefits of self-employed workers.

As the self-employed sector is growing, the mortgage industry is taking a little longer to catch up. By working with a specialist mortgage broker, you’ll be able to navigate the mortgage process with ease.

If you’re ready to make your homeowner dreams a reality, get in touch with Niche Mortgage Info to find out how we can help you get a mortgage if you’re struggling.