Self-employed individuals often have far greater control over their income. If they have a quiet month, they can market their skills or increase their prices. Full-time employees, on the other hand, would have to request a pay rise, and this could take months or even years to be accepted. Despite this increased control over their income, the self-employed often have a much tougher time trying to get a mortgage.

While a full-time employee only needs to be working for a company for 3-6 months to be considered, the self-employed need at least one years accounts in order to apply for a mortgage. All mortgage providers are different, and some will require up to 3 years of accounts before they can go ahead with a mortgage application.

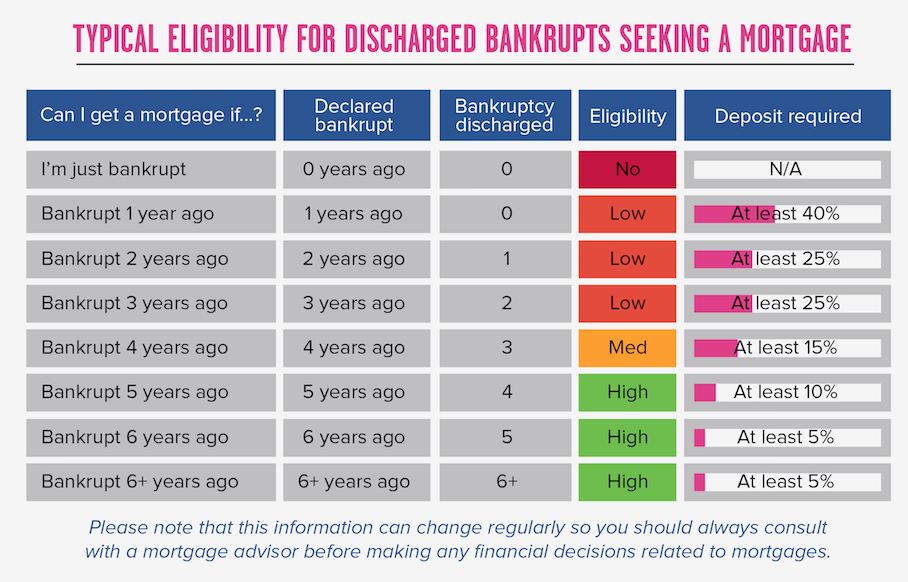

Ultimately, this is to protect the lender and the borrower. Lenders want to make sure that the borrower is going to be able to continue making payments further down the line. As of December 2017, the following applicants would be eligible for a mortgage, subject to status.

It’s a common misconception that you need years and years of trading history in order to get a mortgage. If you’ve been refused a mortgage because you are self-employed, a sole trader or the director of a limited company, this might have more to do with the mortgage provider and nothing to do with your financial circumstances.

If you are serious about getting a mortgage, read on to find out about the ins and outs of mortgages for the self-employed, even if you only have one year of accounts.

To help answer many of your pressing questions, we’ve compiled this guide covering some of the most commonly asked questions about self-employed mortgages with 1 year’s accounts. Get in touch if you have any questions which aren’t answered on this page, or if you would like more information about how we can help.

The majority of lenders, including most high-street lenders, will ask to see 3 year’s of accounts before you are eligible for a mortgage. However, there are mortgage providers that specialise in mortgages for the self-employed. These will consider 2 year’s of accounts when making a lending decision. They will often consider the average of the last 2 year’s of your income, if one is higher, or consider the most recent year if your income remains the same. A small number of mortgage providers will accept applications from the self-employed with just 12 months of accounts. You will need to work with a niche mortgage advisor in order to find out which lenders are most likely to accept your application.

If you haven’t filed your first tax return yet, then it is unlikely that you will find a mortgage provider that is willing to accept your application. This is because mortgage providers use the figures from your tax return to verify your income. You wouldn’t lie about how much money you have earned, because this would mean that you owe more tax and have broken the law. So, lenders use tax returns as a way to verify your income.

If you are nearing the end of your first year of trading, you could, in theory, apply for a mortgage in principle. This is a statement from a mortgage provider that outlines how much they would be willing to lend you. They are valid for 3 months and are used by many people to help them put in an offer on a property with confidence. Once an offer has been accepted, your application will then be processed.

Having a mortgage in principle can allow you to start your search for a new property before the end of your first full year of trading. By the time comes to do your actual mortgage application, it’s likely that you will have your full 12 months of accounts.

Most mortgage providers will ask to see 2 years of accounts, but an increasing number of lenders are waking up to the idea that more and more people are heading down the self-employed route. Many lenders will now simply ask to see as much of your trading history as possible. If you were previously employed in a similar industry and drawing a regular wage, you could also use this in support of your application. If you have 20 months of trading, for example, the lender might also choose to make a project for the full 2 years based on the information provided.

Once you have been accepted by a mortgage provider, you will be treated the same as any other applicant. This means that you will be able to borrow the same amount as any other employee. The actual amount that you can borrow will be based on your income. It will usually be around 4x to 5x your annual income. If you are on a higher income, it’s possible that you may be able to stretch this further, provided you can prove that you can afford it.

The more accounts you can provide, the better, but in general, lenders will be on the cautious side unless you can demonstrate why they should increase the amount. If you have incomplete accounts for your second or third year, you may be able to use projections to show why you should be able to borrow more.

For example, if you net profit for the tax year ending in 2017 was 22,000 and your net profit for the first 9 months of 2018 was 25,000, then an accountant might be able to demonstrate why your earnings are likely to be higher. At an average rate of £2,770 per month for 2018, the full 12 months could be as high as £33,300 for the whole year.

A lender offering 5x annual income would offer a £166,000 mortgage on the projected amount or just a £110,000 for the first year of trading. This is a huge difference, so it’s worth investigating if your mortgage provider will consider projected income estimates. Income isn’t the only thing that your mortgage provider will consider.

Lenders aren’t so too concerned with your occupation, provided the work is legal and that you create a tax return every year. Lenders are very flexible about who they lend to and are more concerned with determining affordability. It’s common for taxi drivers, plumbers, electricians and tradespeople, musicians, landlords, retailers, those running online businesses, professionals and investors to all be able to secure a mortgage. If you’re not sure if your occupation will be accepted, it’s best to speak to a mortgage provider to get clear answers before proceeding. In general, however, your actual occupation won’t be contested by a mortgage provider.

Prior to 2011, the self-employed could take advantage of self-cert mortgages. These allowed the self-employed to tell lenders how much they earn without providing any evidence. This type of mortgage helped many self-employed people to get on the property ladder. Unfortunately, they soon became known as the liar’s mortgage, as so many people inflated their income to be able to borrow more money. These mortgages were ultimately not affordable and many people lost their homes as a result.

In 2011, this type of mortgage was banned during the Mortgage Market Review. As a result, it’s now a lot more difficult for the self-employed to get mortgages as lenders now have to take more steps to ensure they are lending responsibly. While it is harder to secure a mortgage when self-employed, it isn’t impossible. If you are rejected by one lender this doesn’t mean that you cannot get a mortgage.

The majority of lenders will want to see your net profit for the past 12 months to three years. Many people forget that turnover is not the same thing as net profit. This is why most lenders will ask to see your SA302 statement in order to calculate how much you can borrow. The SA302 statement is your end of year tax statement which shows your income and tax liability for the year.

Some providers will also ask to see detailed accounts showing where your money is coming from and how often you get paid. These will often need to be drawn up by a qualified and chartered accountant using professional accounting software. Even if your accounts are handled by an accountant, it’s important that you have a solid understanding of your finances. This can be helpful in explaining things like seasonal fluctuations or spikes in your income.

If you are hoping to use projected income figures as part of your application, then it’s important that you can explain why your income is likely to increase or remain steady in the next few months and years. If you have recently secured a large contract, for example, this would be helpful in securing a higher mortgage amount.

Many people assume that it’s the end of the road if you have poor credit, but this couldn't be further from the truth. Even with a CCJ, some mortgage providers will still consider your application and the occasional late payment isn’t enough to make you ineligible for a mortgage.

As a general rule, applicants with poor credit will need a higher deposit, usually around 15% of the property value. CCJs and defaults more than 2 years old will also be ignored, even if the CCJ isn’t settled. Even missed or late payments on your credit accounts in the last 12 months won’t rule you out for a mortgage. Many lenders also disregard any issues with mobile phone companies.

If you are concerned about your credit report getting in the way of securing a mortgage, the best thing you can do is ensure you have a complete picture. There are three different credit agencies in the UK and you can access your records for free by signing up for free trials with Experian, UK Credit Ratings and Check My File.

Once you have a complete view of your credit profile, you can correct any mistakes, close dormant accounts and ensure everything is up-to-date. If you aren’t sure if your credit report is going to be an obstacle to getting a mortgage, then speak to a mortgage advisor who will be able to read between the lines of your report and identify the aspects which lenders look out for.

The way lenders interpret your credit score is not an exact science and they don’t generally publicise their approach. Your credit report is one part of a wider picture and it is used to get an idea of your past financial behaviour in order to determine if you are a low-risk borrower. Mortgage providers want to see that you make payments on time, so the worst thing you can do is stop using your credit facilities. They can’t see that you have a track record of making credit payments on time if you never use your credit card.

It’s also important to check your credit file regularly so that you can spot problems as they arise. It’s not uncommon for people to move house, fail to close their phone account properly and then end up with an open account that they have no idea about. This can quickly turn into a CCJ if the phone provider can’t reach you. By checking your credit report quickly, you can respond to issues like this in a timely manner before they become problematic for your credit application.

The number of lenders offering the attractive help-to-buy mortgage scheme to the self-employed is low, but they are out there. The help-to-buy scheme allows people to apply for a 95% mortgage with just a 5% deposit. It is intended to help people get on the property ladder who might otherwise struggle to save up a large deposit.

There are restrictions on the help-to-buy scheme and lenders will make much stricter checks. For the self-employed, this means that you will need to jump through yet more hoops in order to prove your eligibility. For example, if you have a CCJ of over £500 registered in the past 3 years, you won’t be eligible for a help-to-buy mortgage. You also can’t use the help-to-buy scheme for a home you intend to rent out (buy-to-let) or for a holiday home.

Remortgaging is often a similar process to securing to main purchase mortgage. You will need to prove that the repayments will be affordable and you will need to provide at least one year’s accounts in support of this. If you are thinking about remortgaging, it’s often best to return to the bank that supplied your first mortgage. They have a pre-existing financial relationship with you and may look more favourably on your application than a new mortgage provider would.

Lenders will always look at the bigger picture, which includes factors such as your past financial behaviour, your current circumstances and commitments and the general affordability of your loan.

The simplest way to increase your chances of getting a mortgage is to secure a large deposit, usually around 15%. This helps to bring down the amount that you are borrowing. The next step is to clear up your credit report and ensure your accounts are all up to date. And finally, you should get your accounts in order so that you can prove your income. If you have been trying to keep your income down through legal methods in order to limit your tax liability, it’s important that you stop this or you could end up being able to borrow much less.