In this guide, we are going to look at how to secure a mortgage, common mistakes to avoid along the way, and what to do if you aren’t accepted the first time. Read on to discover the Niche Mortgage Info guide to getting a mortgage.

The boring stuff

A mortgage is a large loan from a lender to purchase a property. Since the average house price in the UK is now £237,963 and most people don’t have this kind of money lying around, the majority of people turn to mortgage providers to secure the funding.

There are a few different factors you need to know when applying for a mortgage. The amount of deposit you can provide will help to secure a better deal. The length of the mortgage term will also change the mortgage application. And finally, the interest rate structure will determine how your interest rate is determined.

Before the 2008 financial crash, it was common for lenders to offer 100% mortgages. This meant that anyone could approach a bank with proof of income and apply for a mortgage to buy a property, often without the adequate checks.

If a bank has to repossess a home because of missed mortgage payments, they will have to sell the property. If the value of the property has fallen, as many did, they are unable to recoup the full value of the home. This is one of the contributing factors that led to the financial crash. And this is why lenders now ask for a deposit and carry out stringent checks. Our Guide to getting a mortgage will now break all the stages down in more detail.

Deposits explained

The biggest obstacle for homeownership is often the deposit. Lenders will typically want borrowers to provide at least 5% of the property value as a deposit. Though Covid has led to most lenders only accepting deposits of at least 10%. With a smaller deposit, you can expect higher interest rates. Ideally, you should aim to save a deposit that is 20-25% of the property value.

If you are unable to save this amount of money, you could get help from a Government Help to Buy scheme. These schemes are intended for first-time buyers. The government tops up your 5% deposit with a low-interest loan. This allows you to secure a better deal on your mortgage. However, you will then need to pay your loan and mortgage payments, so this could drive up your monthly expenses until the loan is repaid.

Unfortunately, with 100% mortgages now a thing of the past, it has become more difficult for individuals to get on the property ladder. Setting your sights on a smaller property is one way to boost the value of your deposit. Once you have built some equity in your home, you could upgrade to a bigger home.

Your credit score and how it impacts a mortgage decision

Your credit score is a key factor that helps lenders to make a decision. A good credit score and a healthy deposit will give you access to the best rates and mortgage products available. But a poor credit score combined with a smaller deposit might hold you back.

Your credit score will be different according to different credit checking agencies. The three main agencies are TransUnion, Experian and Equifax. Different lenders may use different agencies, and some will look at all three, so it’s important to get a complete picture.

Your credit score takes into consideration the amount of credit available to you, how well you make repayments and other key financial information. Some lenders will automatically reject your application if they see signs of financial instability such as going beyond your agreed overdraft or transactions from betting websites.

Keep a close eye on your finances on the run-up to your mortgage application. You need to make sure you are spending within your means, making all payments on time and avoiding asking friends or family for money.

Lenders will also ask to see the last three months of bank statements. This will not only help to prove that the income you have stated is correct, but it also helps them to spot signs of instability. Avoid extravagant or outlandish purchases during this time. You can get a free check here.

Your income and your mortgage application

Above all else, lenders want to know that your mortgage is affordable. The best way they can confirm this is by looking at your income. Those in full-time salaried employment will have an easier time proving their income.

You may be asked to provide a P60 or your last few payslips. If you have recently started a new job, it may be helpful to wait until you have passed the probationary period before you submit your mortgage application. This will give the lender more reassurance that your income is steady.

If you are self-employed, the process of proving your income is altogether more complicated. Many lenders will ask to see the last three years of your trading accounts. If you cannot provide this – because you have recently switched to self-employment, for example – then you may have to shop around for a lender that understands your situation.

The self-employed may have to jump through more hoops to be able to secure a mortgage, but once approved, they will have access to all of the same lending products. In this sense, there is no such thing as a “self-employed mortgage” only a self-employed applicant.

Understanding brokers

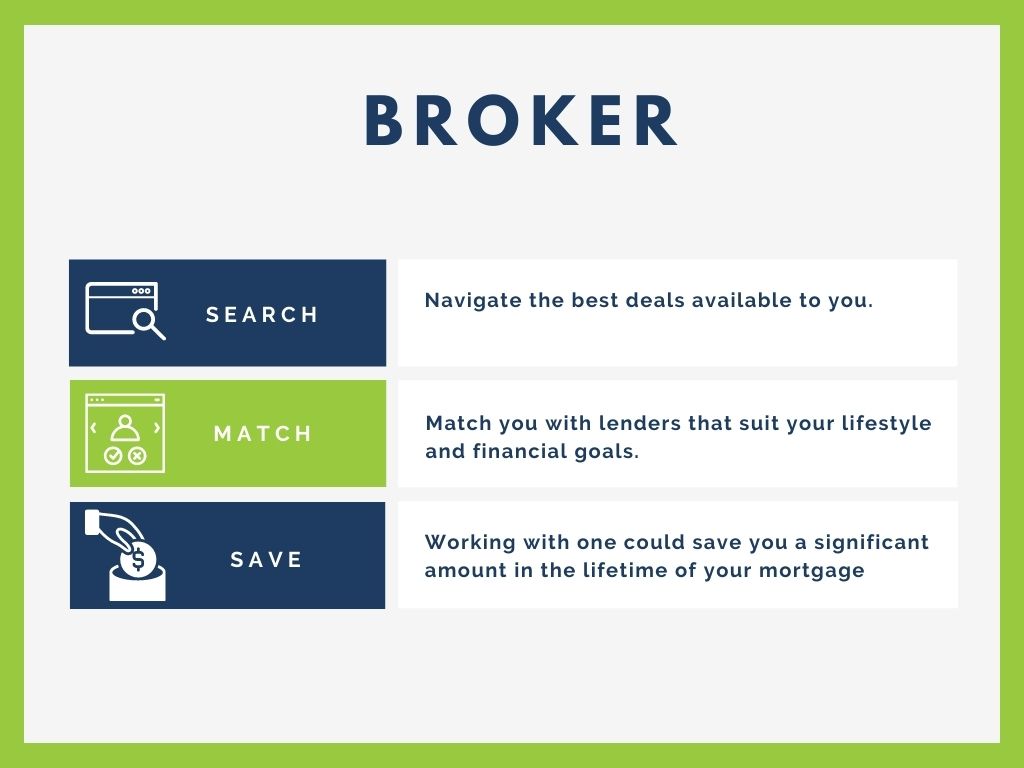

When navigating the mortgage market for the first time, you might be overwhelmed by the options available to you. Many first time buyers make the mistake of going straight to their bank for a mortgage. They assume that the existing relationship they have with the bank will give them some kind of preferential treatment. This isn’t always the case.

We recommend working with a mortgage broker to help navigate the best deals available to you. Having a mortgage application rejected can be distressing to first-time buyers. This is why we recommend working with a broker who will help you to find the kind of deal you are most likely to be accepted for.

A broker can look at the whole market and match you with lenders and mortgage products that suit your lifestyle and financial goals. If you’re determined to pay off your loan as quickly as possible, a broker can help you find a lender that accepts overpayment without a fee. And if you want lower payments at the start of the term, a broker will be able to match you with a great introductory deal.

While a broker will cost money in the beginning, working with one could save you a significant amount in the lifetime of your mortgage. And the expertise they bring to the table could help you to avoid making a significant mistake. Not to mention, it can be helpful to be able to outsource this time-consuming part of the mortgage application process. (please see the list of top questions to ask a broker)

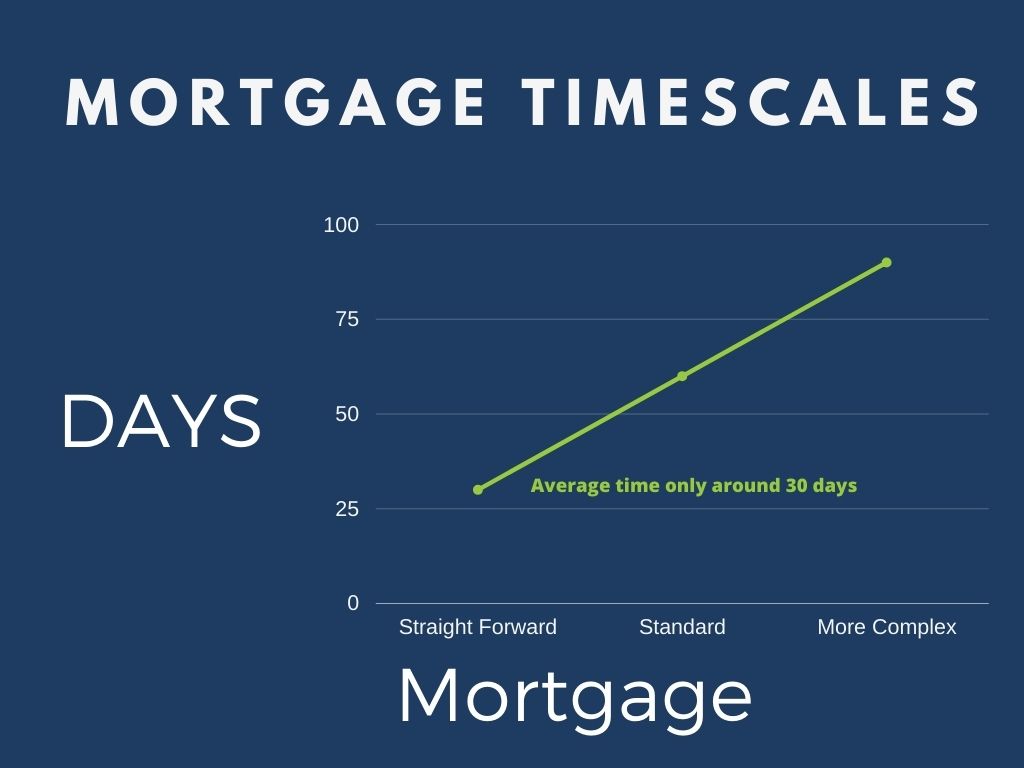

Mortgage timescales

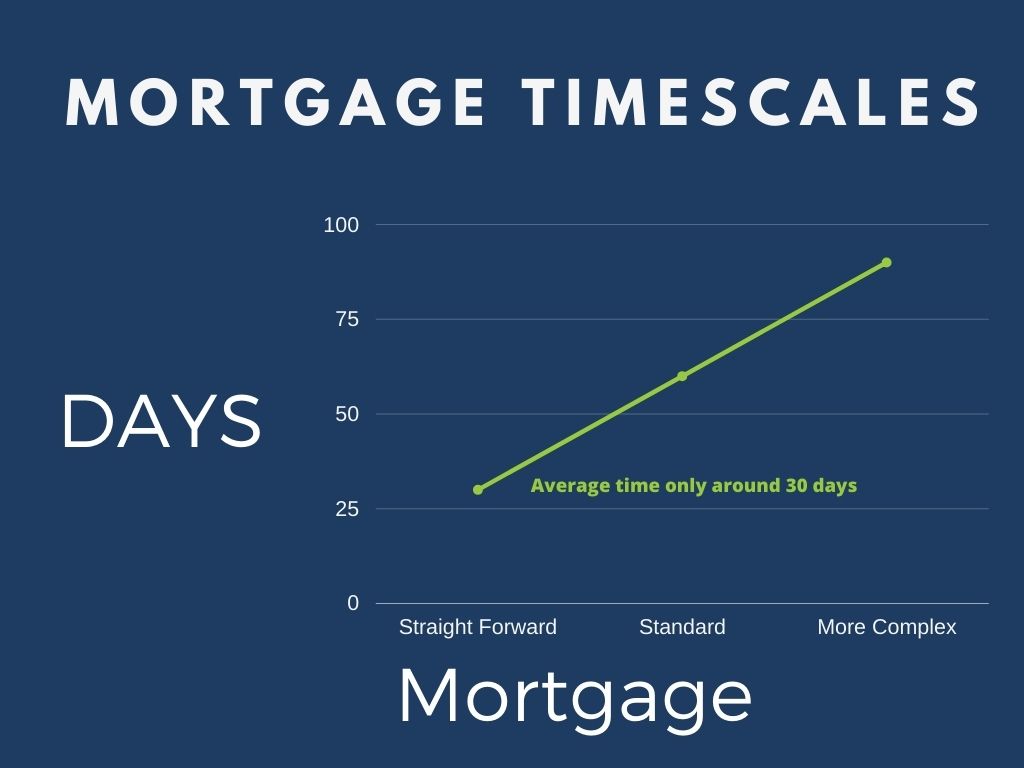

The average time to secure a mortgage from start to finish is only around 30 days, but the actual home-buying process might take much longer. It can be risky to wait until you have found a property you love before applying for a mortgage. Instead, you should apply for something known as a ‘mortgage in principle’.

This is a stripped-back mortgage application that doesn’t go into too much depth. This allows you to start your search in the confidence that the bank is likely to lend you the funds, provided the property valuation is in order and you pass the final checks. A mortgage may be rejected once the mortgage in principle has been granted, but this doesn’t happen often.

As with all administrative tasks, the quicker you can respond with the required documents, the quicker the process will be. This is why it is helpful to be responsive during the mortgage application to keep things moving along. Working with a broker can help to speed up the process, but sometimes the checks and processes take longer.

Common reasons for a declined application

When a mortgage is declined, it’s stressful, but not the end of the road. Being declined by one lender does not mean that you can never secure a mortgage, it may simply mean that you need to wait a while, clean up your credit score and try with a different lender.

The most common reason that a lender will decline a mortgage is that they have uncovered something in your financial history that makes them nervous. This might be a discrepancy in your income, a transaction that hints at irresponsible spending, or late payments. Even something as simple as too many credit applications in a short space of time can be enough for a lender to turn you down.

If your mortgage is declined, try to find out the reason so you can fix it. If the reason is something like a CCJ that hasn’t been removed from your record yet, you can quickly amend this before making a new application.

If possible, try to avoid having any hard credit checks on your record before you resubmit your application. This could mean waiting around three months to submit another application. It might be stressful and you might have to say goodbye to a home you love, but this will increase your chances of being accepted the next time.

Choosing your mortgage rates

There are a few ways you can control the amount you repay every month. Your repayments will be determined by your deposit, your mortgage term and the interest rate. Increasing the mortgage term will lower your monthly repayments but increase the amount you pay back overall. The best way to secure a better deal is to shop around for the best interest rates.

Fixed vs variable rate interest

When you start your mortgage journey, you will notice that mortgages fall into one of two categories: fixed and variable rate. With a fixed-rate mortgage, your interest rate will stay the same for the duration of your mortgage. The only thing that will change it will be if you remortgage, but this would be an entirely new mortgage product.

A fixed-rate mortgage will typically be higher than the Bank Of England base rate (currently at 0.1% in October 2020). This is because lenders need to account for increases to the interest rates. A fixed-rate mortgage will make it easier to budget and could allow you to make regular overpayments to reduce the term and cost of your mortgage.

With a variable rate mortgage, your monthly repayments will depend on the interest rate set by your lender. Often, they will be linked to the Bank Of England base rate, but not always. A tracker mortgage will often be set at a percentage above the base rate. So, if interest rates go up, your monthly payments will increase. But if they go down, they will decrease. Many variable rate mortgage interest rates are set by the lender, so they can increase or decrease without notice. Only choose this type of mortgage if you are confident you will be able to make up the difference if the interest rate goes up.

A note on introductory offers

When shopping for a mortgage, you might feel like you are pleading for scraps, but you hold more power than you think. Lenders are keen to get your business, as there is no shortage of lenders out there. Provided you have a secure income and a healthy-sized deposit, there is no reason you shouldn’t be able to secure a mortgage.

With this in mind, think about how you can make your status work to your advantage. Some lenders will offer a fixed term as long as 10 years, which should give you plenty of time to budget, make plenty of overpayments and then remortgage when you hold a greater portion of the equity. You may also find lenders willing to cover things like conveyancing fees to help convince you to sign with them.

With all mortgage products, always think about the lifetime value of the offer and how this will shape your finances in the next 5, 10 or 20 years. Understanding the lifetime value of your interest rates and repayment term will help you to make a rational and sound choice.

We hope you found this guide to getting a mortgage helpful. If you need any help with getting a mortgage then please try our mortgage qualifier via the button below.

Buying a home is a huge investment, perhaps the biggest one you will ever make. This is why it is important that you understand the process and the external factors that will impact your application. Securing a mortgage for the first time can be daunting. And with so many new terms to learn, you might quickly feel out of your depth. Minimum deposits, interest rates, legal structures and repayment terms can leave you feeling like you need to go back to school.

Buying a home is a huge investment, perhaps the biggest one you will ever make. This is why it is important that you understand the process and the external factors that will impact your application. Securing a mortgage for the first time can be daunting. And with so many new terms to learn, you might quickly feel out of your depth. Minimum deposits, interest rates, legal structures and repayment terms can leave you feeling like you need to go back to school.