If you’ve found this page, chances are you are concerned about being accepted for a mortgage because you are self-employed. In this article, we will explore some of the things mortgage lenders are looking for when they make lending decisions and advise on ways you can help ensure your self-employed mortgage application is successful.

Mortgages for the self-employed used to be a lot simpler and had a higher acceptance rate. Self-employed individuals could self-certify their income to lenders, effectively giving borrowers the control to decide how much they should be allowed to borrow. These mortgages were often abused by people in order to borrow more than they could afford. They were subsequently banned in the UK following the credit crunch.

Now, self-employed borrowers need to prove their income in order to be accepted for a mortgage. This makes it difficult for the newly self-employed, as lenders will often take an average of their last few years of income when making a decision.

While mortgages for the self-employed might seem harder to come by, it isn’t impossible. If you are determined to get on the property ladder, there are always mortgage providers who will be willing to help you if you are able to jump through their hoops.

As the name suggests, sole traders are one-man bands. If you set up your self-employed business as a sole trader, then calculating your income will be much easier as all company profit is yours to keep.

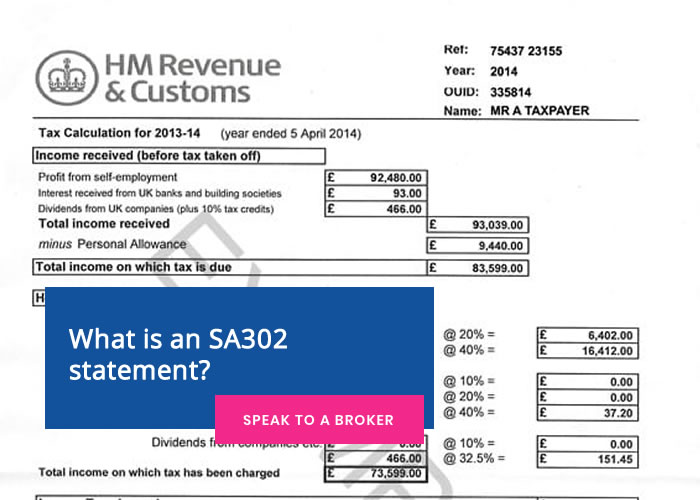

When considering your income, mortgage lenders will usually want to see at least 2 year’s worth of accounts. They will usually ask to see your SA302 form from HMRC. This is your end of year tax document which outlines your income and expenses and your tax liability.

Most mortgage lenders will either calculate your average income for the past two years if the most recent figure is higher. They might also just consider the most recent year’s total income. Some lenders will ask to see SA302 forms for the past 3 years and work out the average of all 3.

If you run a limited company, you will likely have a few different income sources. Most company directors take a basic salary and then dividends. Some directors choose to leave profit in the company, so it’s important to find a lender that understands these different income sources and will take them into consideration when making your lending decision.

From our experience of working with self-employed mortgage providers, we have found that Virgin, Woolwich, Clydesdale, Kensington, the Halifax and the Coventry are all open to applications from self-employed individuals. What’s important is that you speak with a mortgage advisor as soon as possible as they will be able to help you to understand your options. You might be declined from one lender and accepted by another, so don’t take an initial setback as a sign that you cannot get a mortgage.

Your turnover is not your income, so don’t be caught in this common borrowers trap. Lenders will only look at the taxable portion of your income, meaning your profit.

Very few lenders will accept sales projections in lieu of the whole two-year’s worth of accounts, so it’s best to wait before applying for your mortgage. It doesn’t seem fair that you have to be running a business for 2 years before getting a mortgage, whereas a full-time employee only needs to have a job for around 3-6 months before applying. It doesn’t seem fair but company directors will have a hard time getting a mortgage while the people they employ will have it much easier.

When you file your tax return with HMRC, you will be provided with a calculation of your tax liability in the form of a SA302. This provides lenders with evidence of your earnings. A common problem that people face is that they sometimes legally adjust their income in order to pay as little tax as possible, but when it comes to getting a mortgage, they want to inflate their income as much as possible. If you are planning to apply for a mortgage, it is best to be upfront and honest about your earnings.

You can request your SA302 on your online government portal account, or you can request one be sent to your home. Requesting one by post can take up to 2 weeks to arrive. It’s best to have an accountant help you prepare your accounts for a mortgage assessment as they will know what steps to take to give you the best possible chance of securing a mortgage, However, it’s important that you understand your income and can explain things like seasonal fluctuations and dips or peaks in income when asked.

No, but it is often the easiest option. Most lenders will either accept your SA302 as provided by HMRC, or a tax calculation that was taken from professional accounting software. If you have your own accountant, they will usually be able to help you to prepare your accounts for a mortgage application. It’s always best to have the documents ready before you start your mortgage application as it can hold up the process.

Very few lenders will accept self-employed borrowers with less than one year of trading history. You might have a very strong start to your company followed by a slump in sales. If you nearing the end of your second year of trading, it’s possible that a lender will consider your application if you also have a strong credit history, an existing relationship with the bank, or a healthy deposit. Every self-employed person is different, so the best first step you can take is to speak to a mortgage advisor who will be able to determine which lenders are most likely to accept your application.