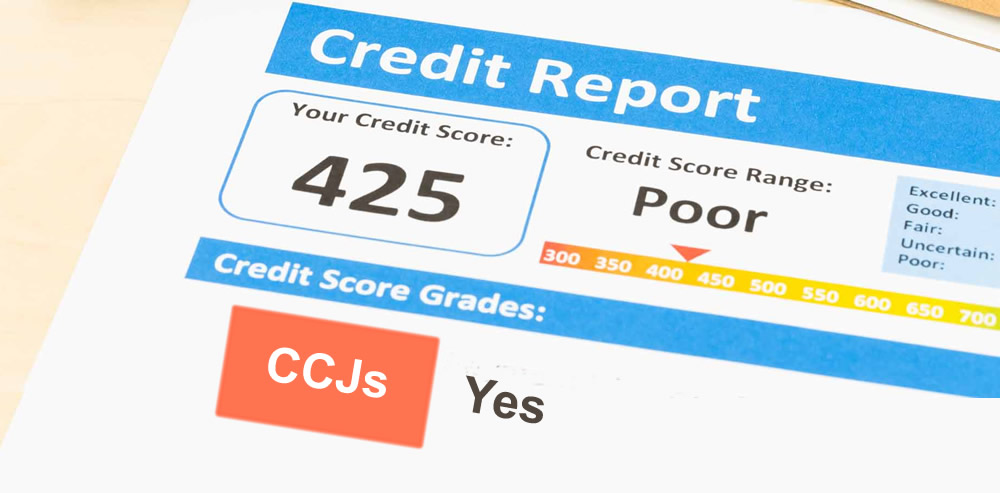

A CCJ, or County Court Judgement is an order by the court to repay your debts. They occur when creditors take a debtor to court if they are behind on their repayments. Before a CCJ is applied, the debtor has the opportunity to repay their debt within a certain timeframe to avoid a CCJ. If they are unable to do so, they will be forced to create a repayment schedule that is based on affordability. A record of the CCJ will remain on the individual's credit report for six years, but in reality, they are left suffering for much longer than this.

Since many responsible lenders will reject credit applications from those with CCJs, this opens the door to unscrupulous lenders to target the vulnerable. High-interest loans with obscure terms and debilitating late payment fees can make a bad situation worse for someone with a CCJ on their record. Through no fault of their own, they can be tricked into becoming an irresponsible borrower simply because they do not have access to affordable credit.

Individuals with a CCJ on their file will have to wait six years to see it removed. And even after it has disappeared from their credit report, they still have to contend with six years of poor credit history. Credit reporting relies on one thing: borrowing. If you do not have a history of borrowing money and making regular repayments, then your credit history will be poor. In fact, someone with no debt at all will often have a lower credit score than someone with lots of debt, even if the former is acting more responsibly than the latter.

Punished twice

Individuals with a CCJ on their credit report are not just blocked from affordable lending in the form of loans and credit cards. They can also find it a lot more difficult to get a mortgage. This can trap individuals in the rental market and make it more difficult to get on the property ladder in future. With the cost of rent rising, people with CCJs can find that they are punished twice. If they are able to secure a mortgage, they will need to put up a larger deposit or accept higher rates of interest.

Mortgage providers are changing their ways and there has been an increase in the number of adverse credit history mortgages available. However, most high street lenders will automatically reject applications from those with CCJs. This leads to the unrealistic perception that CCJs exclude individuals from getting a mortgage, particularly when individuals aren’t aware of the existence of specialist mortgage providers. Perceptions are changing, but there is still a long way to go to ensure that people aren’t locked out of affordable finance. For example, lenders should look not only at the presence of the CCJ but the CCJ amount and the number of CCJs on record.

Imagine an individual loses their job and has short-term financial problems that lead to a number of CCJs. After securing another job, they repay the CCJ ahead of time and are financially stable again. It seems unfair that this person should be locked out of affordable finance when they have a steady income and an otherwise gleaming credit history. It isn’t only those with CCJs, IVAs and defaults who suffer. Even the self-employed can struggle to obtain credit as a result of their status.

Mortgage providers have a responsibility to ensure they are offering a range of products to all customers and not excluding people based on adverse credit history. And this should include taking into consideration individual circumstances, current affordability and evidence of responsible borrowing.