How to improve your credit score?

Your credit score is something you probably don’t have to think about very often. But when the time comes to apply for a mortgage, your credit score will be all you can think about. Credit scores can often derail mortgage applications, so it’s worth getting clued up on yours.

Plenty of companies will offer to improve your credit score for a fee. But unless your credit score is low because of a mistake, there is little that an outside company can do that you can’t do yourself. By taking control of your own credit score, you can improve your chances of getting a good deal on your mortgage.

Read on to learn more about credit scores, why they matter, and how to improve yours. If you suspect your credit score might be holding you back in your mortgage application, get in touch to see how we can help.

Your credit score is a numerical value attached to your credit report. Financial agencies report your financial behaviour to authorised credit referencing agencies. These companies then organise this information and assign a score based on your behaviour.

Your credit score is also helpful for confirming your identity. It includes information about your address history and your financial links. If you have ever been bankrupt or have a CCJ against you, this information will appear on your credit score, making it harder for you to evade these checks on credit applications.

If you are curious about your current credit score, you can sign up to the major credit referencing agencies. There are free subscriptions available that will allow you to get a rough idea of your credit score. Paid subscriptions will allow you to gain a detailed insight and even make changes if the information is incorrect.

Your credit score will differ for each credit reference agency, so it’s worth signing up for each one to get a more complete picture. Lenders will have their own preferences, so you need a complete picture.

The main credit reference agencies in the UK are:

Each of these companies will offer a free and a paid version, the free version should be sufficient for your needs at this time. If there are issues on your report, a paid subscription might be worth investigating.

When you apply for credit, you are giving permission for the lender to look at your credit score. Any organisation with an existing financial relationship to you can also check your credit score. Many banks will check your credit score periodically to help them assess if they need to make changes to your account.

When you move house, landlords may ask to check your credit score before deciding if they should allow you to rent from them. Some employers may also ask to see your credit report before hiring you, particularly if you will be handling large sums of money. If you are in a lot of debt, you could be a high-risk hire.

Utility companies, insurance companies, government agencies and debt collectors will also be able to see your credit score. In general, you have to give permission before an organisation can look at your credit report, and only authorised organisations are allowed to see it. Every time an organisation requests to see your credit report, this will appear on your search history.

Your credit report does not include information about your salary or your savings. And it isn’t visible to anyone who cares to search for it. Only authorised companies with permission to check it are allowed to search your credit history.

Your credit score is made up of many different factors. Each credit checking agency will have their own scoring system, but in general, they all look at the same factors. These include:

These are just some of the factors that will be used to create your credit score. Some factors will have more impact than others. For example, a CCJ on your record will be more damaging than a missed credit card payment from 3 years ago.

And remember, each credit referencing agency will have its own system for scoring your financial performance. So one agency might place more weight on responsible credit card usage than another. This is why it is so important to get the full picture before applying for credit.

The most common reason that individuals seek to improve their credit score is to prepare for a loan application. When lenders look at your credit report, they use the information to determine if you are a high-risk borrower.

A high-risk borrower might struggle to repay, miss payments and even default on the loan. So if the lender decides to go ahead with an application, they will attach a higher interest rate to the loan.

When you have a low credit score, it costs more money to borrow money. This means that those with a high credit score will typically have access to the best lending products. So when you are looking for a high-value loan like a mortgage, it can save you tens of thousands in interest payments by simply improving your credit score.

Most credit referencing agencies update your credit score every month. So while you could see small short-term improvements, it’s more likely to be a long-term task. This all depends on the factors that are holding you back. For example, a CCJ on your record is perhaps one of the worst things that can happen to your credit report. This will stay on your credit report for 6 years.

Your entire credit report lasts 6 years, so if you had a period of financial difficulty and struggled to make your credit card payments 5 years ago, you would have to wait 1 year until this period drops from your credit report. However, it’s worth noting that historical blunders will carry less weight than more recent mishaps.

The length of time it takes to clean up your credit report and improve your credit score will depend on the type of issues you are facing. Some of the steps outlined below are short-term fixes and some are long-term goals.

If you suspect your credit score might be holding you back from either securing credit, or securing a good interest rate, there are steps you can take. Remember that changes to your credit report can cause your score to go down as well as up. If you need to start building credit from scratch, you should do this well in advance, as the credit application will still be fresh on your file. If your credit score is holding you back, you should be prepared for the possibility that this could hold up your plans for homeownership by months, or even years. You can use this time to boost your savings, allowing you to lower the LTV amount and secure an even better year.

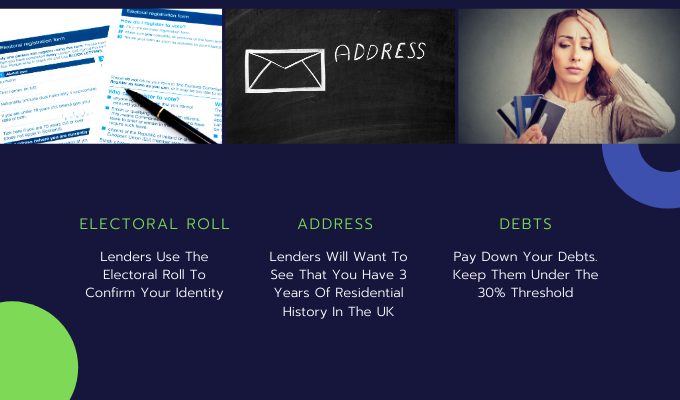

Although a small factor to consider, it is nonetheless worth getting this step completed before any credit application. Lenders use the electoral roll to confirm your identity, so this is one of the first steps you should take. It only takes a moment to get on the electoral roll, but it can take much longer for this to appear on your credit report.

When applying for any credit, lenders will want to see that you have 3 years of residential history in the UK. If there are mistakes on your address history, you won’t be able to add them in, but it can help you to spot fraud.

Look for any addresses you don’t recognise and then determine the financial link. Each address will be linked to some kind of lending, insurance product or utility service. If an account has been left open, or if an account has been opened fraudulently, this will be evident from your address history.

A common problem that recent graduates face is when utility accounts from their student house are left open in their name. When this happens, any debt accrued on the account will negatively impact your credit score. Identify any outdated accounts and make sure you close them.

If possible, use some of your savings to pay down your debts and keep them under the 30% threshold. If you have 2 credit cards and have the choice to pay off one entirely to close the account or pay both partially to bring it under 30% of the credit limit, the latter choice would be better.

It’s a common misconception that those with zero debt have the best credit scores. Lenders actually want to see a history of responsible borrowing, as it gives them confidence that you will be able to repay your debt to them. If you have no debt payment history, this can be just as bad as having a history of missed payments.

Lenders typically want to see that you keep your debt under 30% of your threshold. So, if you have a credit card with £1,000 of credit, keep your monthly balance under £300. The same goes for overdrafts and store credit cards.

As you are nearing your mortgage application, avoid applying for further credit. This can make lenders more nervous if you have a large portion of unused credit.

If you are starting from scratch with no credit history, you need to find a way to start building it. This can be difficult to achieve, as lenders will want to see your credit history before granting any credit. But without a credit facility, you can’t build your credit history.

Many students overcome this by applying for a student credit card. This will change into a normal credit card after graduation. When used responsibly, this can be a great way to build your credit as you start your career. However, if you lack the financial discipline to use the credit in the right way, you might simply end up with debt you struggle to repay.

A prepaid credit card can help you to start building your credit score and can also be helpful for making large purchases online. A credit card will offer additional protections, so you can shop online with confidence.

After you have built a credit history, you can then apply for a real credit card. The bank you have a current account with is often the best place to start. Banks will typically offer a low credit limit, which may only be around £500. Spend a little on the card every month and then pay it back in full to start building a history of good credit behaviour.

Your credit report is often the best way to identify fraud. Before making any credit applications, you should always check that fraudulent activity isn’t costing you more in interest payments. If accounts have been opened in your name without your knowledge, this could be negatively impacting your credit score.

If you suspect fraud has taken place, you will need to file a report with Action Fraud. You should also apply a notice of correction password to your credit report. This is a signal to lenders that you have been a victim of fraud in the past. It will trigger them to request your password before granting any line of credit to you.

If you have even held a joint account, you may be financially linked to that person, and their financial behaviour could be dragging your score down. The most common source of financial relationships is one you might have with your partner.

If you are broken up, make sure any accounts you held in both of your names are closed. Many couples will break up and one will continue using the shared account. This will preserve the financial relationship and could damage your credit score in the future. If your ex-partner were to get into a lot of debt and be unable to repay, this could reflect negatively on your account.

Another common source or financial relationships is student house accounts. If you have set up a shared account to make bill payments during your time at university, you could still be financially linked to those you once lived with. Make sure all accounts are settled and closed to sever this tie.

One of the simplest ways you can keep your credit score on track is to make sure you make all payments on time. When you look at your credit report, you will see the financial history of each lending facility you have in your name. For each month, you will see a dot that will either be marked as on-track, late or missed.

Avoid having any missed or late payments on your record, as these can drag your score down. The easiest way to achieve this is to set up direct debits to make payments for you. This will eliminate the risk of missing any payments. If you are struggling to make payments for any reason, always contact the lender as they may be able to arrange a payment holiday which will not be reported as missed payments on your credit report.

Repeat applications for credit can negatively impact your credit score. If you have been rejected for credit from one lender, don’t immediately turn to another lender. When applying for a mortgage, lenders will not see if your credit applications have been successful, just that they happened. These will show up in your credit search history, and it will state if the search was a soft search (speculative) or a hard search.

A lender might be concerned that after granting you a mortgage, you could go on a spending spree on multiple credit cards and be unable to repay your debts. In the run-up to applying for a mortgage, you should stop applying for credit and give it time for recent applications to fall down in your credit history. An application made 6 months ago is less damaging than an application from 2 weeks ago.

While your credit report might take months to update, searches can show up immediately, so it’s not worth running the risk that this could derail your application. Remember that some things that might not seem like credit facilities will be seen as such on your application. This includes mobile phone contracts and insurance products. Many insurance providers will offer an interest-free loan which covers a full year of premiums, allowing you to pay monthly instead of up-front. As such, this will be considered a type of borrowing and will therefore show up on your credit report.

If you don’t own your house, chances are you rent a home. A common complaint that many renters have is that they are able to make rental payments every month, and yet lenders still doubt their ability to make regular payments.

Changes in 2018 mean that you can now have your rental payments added to your credit report. This can help to boost your credit score and show a history of making payments on time. You can use CreditLadder to report your rental payments to the credit checking agencies, allowing you to build credit while you pay for one of your biggest monthly expenses.

If you are hoping to get on the property ladder, you will probably want to build up your savings. The good news is that you can also use your monthly savings to improve your credit score. We stated above that your savings accounts are not declared on your credit report, but specialist lenders are now offering a unique workaround.

LOQBOX is a unique savings account provider that allows you to determine how much you are able to save each month. This annual amount is taken as a 0.0% interest loan and placed in a locked savings account. You will be unable to access the savings until the end of the term. Instead, you make regular monthly payments to “pay back” the loan.

At the end of the year, the money is yours, and you have a history of regular loan repayments to help bolster your credit report. For those who struggle to save money and need a little added incentive, this can be a great way to stay motivated.

Your credit report might never be perfect, but the steps above should help to keep you on track. Remember that even those with low credit scores will be able to secure credit, it will just cost more money. So by improving your credit score, you could decrease your interest rate and save money in the long-term. Being aware of how your credit score impacts your borrowing position is one of the best ways to stay one step ahead and secure a good deal. If you need help finding a lender who will work with you, get in touch to find out how we can help.